UnitedHealth Group has been a stock market darling for much of the past decade, dependably churning out earnings increases and rewarding shareholders with staggering returns.

Author Archives: Admin

7 Ways to Invest in Yourself

Increasing your earning potential is one of the best ways you can improve your finances.

Insurance status impacts complication rates after shoulder replacement surgery

Patients undergoing shoulder replacement surgery who have Medicaid, Medicare or no health insurance, had higher complication rates as compared to patients who had private insurance.

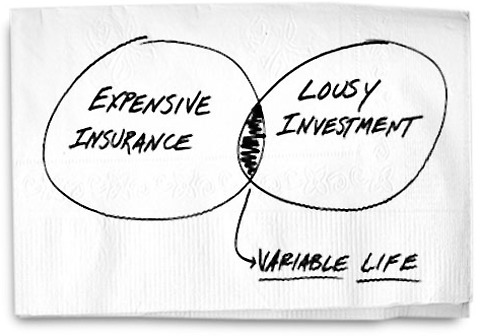

Why Life Insurance Is Not an Investment

Carl Richards is a certified financial planner and the founder of Clearwater Asset Management. He answered questions from Bucks readers in November.

Hopeful signs on health care

This is very big news. One of the key questions about the new Democratic majority was whether Congress would try to play it safe, backing down on big ideas about reform, especially on health care. You can view the whole chorus about how we’re still a “center-right nation” as an attempt by the usual suspects to scare Democrats into scaling back their ambitions.

Be Honest: Are You Really Saving Enough for Retirement?

One of the most important things you can do is to save enough for retirement. Unfortunately, many Americans aren’t saving anything for their future.

Few Americans Think They Own Annuities

Life Happens and LIMRA have published survey results highlighting a serious financial services market analysis problem: American survey takers appear to be hazy about what financial services products they own — and more reliable comparison numbers are hard to find.

Here’s a key way to prevent paying more for your health care than you should

At least 50 percent of the claims reviewed on behalf of DirectPath’s clients contain an error, according to the employee-benefits manager.

Simple mistakes can result in higher bills, which means you should be checking every single bill you receive from a doctor or other provider.

America’s $103 billion home health-care system is in crisis as worker shortage worsens

A startling 75 percent of Americans over 65 live with multiple chronic health conditions, ranging from diabetes to dementia.

The nation’s strained health-care system is trying to keep sick seniors out of hospitals, assisted-living facilities and nursing homes and instead have them cared for in their homes.

The U.S. spent an estimated $103 billion on home health care last year, according to the Centers for Medicare & Medicaid Services.

Overall employment of in-home aides is projected to grow 41 percent from 2016 to 2026 — translating to 7.8 million job openings.

Why using pre tax health savings will keep more money in your pocket

There are two kinds of tax-advantaged savings accounts that let you put money away for health-care needs: flexible spending accounts (FSAs) and health savings accounts (HSAs).

FSAs let you put away up to $2,700 for an individual this year, or $5,000 for a family through payroll deductions.

Under tax rules an HSA is a lot like an IRA savings account; the money you don’t use can roll over from year to year.

You can contribute up to $3,500 this year for an individual and up to $7,000 for a family